Why do typical automobile insurance coverage rates by age differ so much? 5 percent of the population in 2017 however represented 8 percent of the total price of automobile mishap injuries.

accident cheapest auto insurance car cheaper car

accident cheapest auto insurance car cheaper car

The rate data comes from the AAA Structure for Web Traffic Safety, and it makes up any kind of crash that was reported to the cops (cheapest car). The average costs data comes from the Zebra's State of Vehicle Insurance policy report. The prices are for plans with 50/100/50 responsibility insurance coverage limits and also a $500 insurance deductible for comprehensive and also collision protection.

auto insurance car insurance cars cheaper cars

auto insurance car insurance cars cheaper cars

According to the National Freeway Traffic Security Management, 85-year-old males are 40 percent most likely to enter into an accident than 75-year-old guys. Considering the table over, you can see that there is a direct correlation in between the crash price for an age team as well as that age's ordinary insurance policy premium (cheapest auto insurance).

Bear in mind, you may locate much better rates with another company that does not have a certain trainee or elderly discount. * The Hartford is only readily available to participants of the American Organization of Retired People (AARP). Policyholders can include younger drivers to their policy and obtain discount rates. Typical Vehicle Insurance Policy Rates As Well As Cheapest Service Provider In Each State Because auto protection prices vary so much from state to state, the service provider that provides the most inexpensive cars and truck insurance policy in one state may not offer the cheapest insurance coverage in your state.

The Greatest Guide To Why Is My Car Insurance So High? - Investopedia

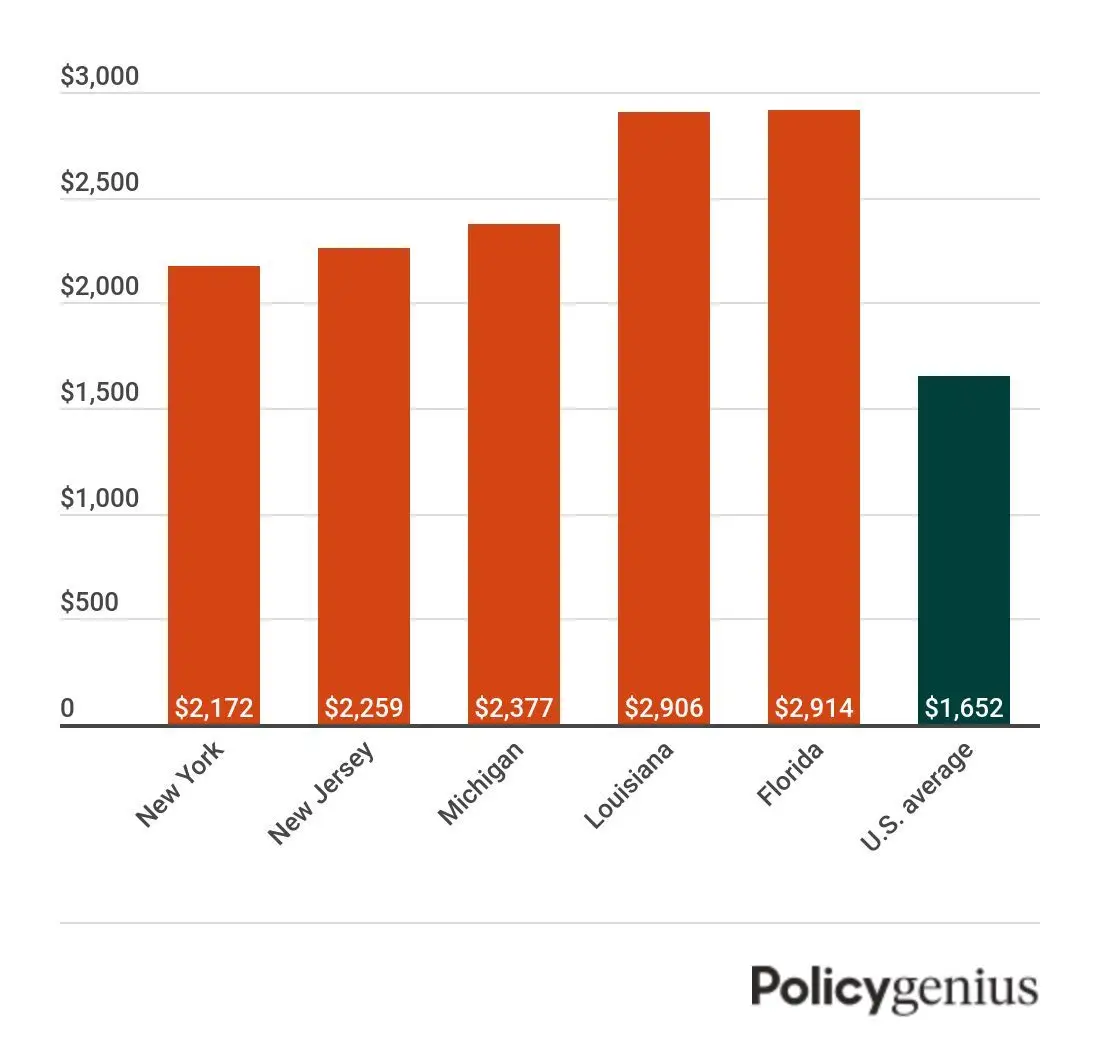

You'll additionally see the ordinary cost of insurance policy because state to assist you compare. The table also includes rates for Washington, D.C. These rate approximates put on 35-year-old chauffeurs with excellent driving documents and credit score - auto. As you can see, average car insurance expenses differ widely by state. cars. Idahoans pay the least for cars and truck insurance coverage, while vehicle drivers in Michigan shell out the big dollars for coverage.

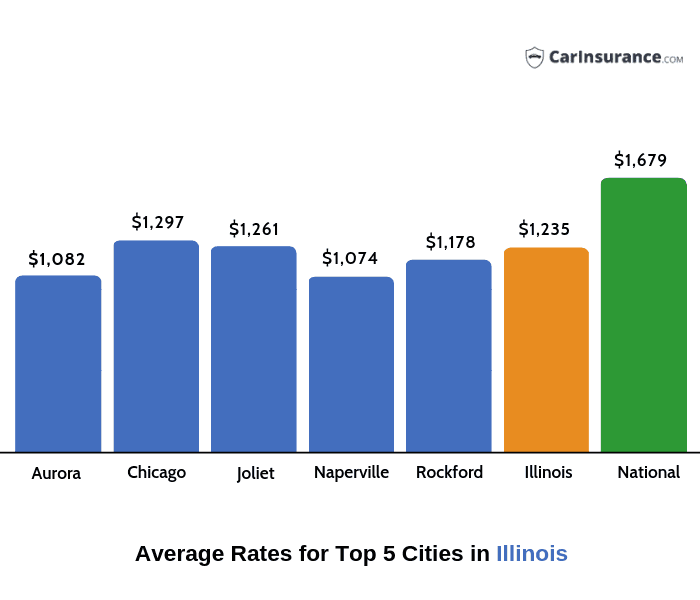

If you live in midtown Des Moines, your costs will most likely be more than the state standard. On the other hand, if you stay in upstate New York, your automobile insurance coverage will likely cost much less than the state standard. Within states, car insurance costs can vary extensively city by city.

The state isn't one of the most costly overall - car insured. Minimum Protection Requirements Most states have financial duty regulations that need vehicle drivers to carry minimum auto insurance policy protection. You can only do away with coverage in two states Virginia and New Hampshire however you are still economically in charge of the damages that you cause.

No-fault states include: What Other Elements Impact Auto Insurance Fees? Your age and your residence state aren't the only things that influence your prices.

The 45-Second Trick For Many Michigan Drivers Drop Unlimited No-fault Insurance

Some insurance providers may provide discounted prices if you don't utilize your vehicle a lot. Others supply usage-based insurance that may save you cash. Insurance firms factor the likelihood of an automobile being swiped or damaged in addition to the price of that automobile right into your costs. If your car is one that has a possibility of being swiped, you may need to pay even more for insurance policy.

In others, having bad credit can cause the expense of your insurance premiums to increase drastically. Not every state allows insurance firms to utilize the sex listed on your chauffeur's permit as a figuring out consider your costs. But in ones that do, women drivers typically pay a little less for insurance than male motorists.

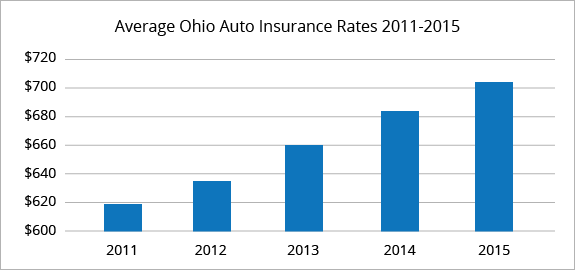

Plans that only meet state minimum insurance coverage requirements will certainly be the least expensive - insured car. Additional insurance coverage will certainly cost even more. Why Do Cars And Truck Insurance Policy Rates Modification? Considering ordinary vehicle insurance coverage prices by age and state makes you question, what else influences prices? The response is that vehicle insurance policy rates can alter for lots of reasons.

An at-fault accident can increase your price as a lot as half over the following three years. If you were convicted of a DUI or committed a hit-and-run, your rates will certainly go up a lot more. Nevertheless, you do not have to be in a crash to experience rising prices. On the whole, vehicle insurance policy often tends to get extra costly as time goes on.

Not known Details About How Much Is Car Insurance? These Are The Average Costs

Luckily, there are a variety of various other discounts that you could be able to take advantage of right now. Right here are a few of them: Lots of companies provide you the largest price cut for having a good driving history. Called packing, you can obtain reduced rates for holding even more than one insurance coverage policy with the exact same firm.

Homeowner: If you own a home, you could get a property owner discount rate from a variety of carriers. Obtain a discount for sticking with the very same firm for numerous years. Right here's a key: You can always compare rates each term to see if you're getting the most effective rate, despite having your commitment price cut.

car prices prices cheapest car

car prices prices cheapest car

However, some can likewise elevate your rates if it ends up you're not a good driver. Some companies give you a discount for having a good credit history. When browsing for a quote, it's an excellent idea to call the insurance coverage firm and also ask if there are any kind of even more price cuts that put on you.

business insurance cheapest car insurance cars affordable car insurance

business insurance cheapest car insurance cars affordable car insurance

One of the biggest factors for clients looking to get auto insurance policy is the rate. Not just do costs vary from company to firm, yet insurance expenses from state to state vary. According to , the average annual expense of cars and truck insurance in the USA was $1,633 in 2021 and also is forecasted to be $1,706 in 2022.

See This Report on How Much Does Car Insurance Cost?

Average rates differ widely from state to state. Insurance policy prices are based on multiple standards, including age, driving background, credit rating, the amount of miles you drive each year, vehicle kind, as well as a lot more. Depending on typical car insurance costs to estimate your auto insurance policy premium might not be one of the most accurate method to figure out what you'll pay.

Insurance firms utilize multiple aspects to figure out prices, as well as you may pay basically than the average vehicle driver for coverage based on your danger profile. More youthful motorists are typically a lot more likely to get into a crash, so their premiums are generally greater than average. You'll likewise pay more if you have an at-fault accident, multiple speeding tickets, or a DUI on your driving document.

It may not offer adequate defense if you're in an accident or your vehicle is damaged by one more covered case. Interested concerning exactly how the typical rate for minimal insurance coverage stacks up versus the price of full insurance coverage?

The only way to recognize precisely how much you'll pay is to shop around as well as get quotes from insurance firms. Among the variables insurance firms make use of to determine rates is area (insured car). Individuals that live in areas with greater theft rates, crashes, and all-natural disasters commonly pay more for insurance (affordable car insurance). And considering that insurance policy legislations and minimum protection needs differ from state to state, states with greater minimum requirements usually have higher ordinary insurance coverage costs.

Average Cost Of Car Insurance In The U.s. For 2022 - Us News for Dummies

Most yet not all states permit insurance provider to use credit rating when establishing prices. As a whole, candidates with reduced ratings are more probable to sue, so they generally pay a lot more for insurance than vehicle drivers with greater credit rating scores - car insurance. If your driving document includes crashes, speeding tickets, Drunk drivings, or other offenses, expect to pay a greater costs.

Autos with greater price typically set you back more to insure. Vehicle drivers under the age of 25 pay higher prices due to their absence of experience as well as raised mishap threat. Guy under the age of 25 are generally estimated greater rates than women of the exact same age. But the void shrinks as they age, as well as females might pay slightly much more as they grow older.

cars cheap car car trucks

cars cheap car car trucks

Due to the fact that insurance firms have a tendency to pay even more cases in risky locations, prices are typically higher. Obtaining adequate insurance coverage may not be low-cost, yet there are methods to obtain a price cut on your auto insurance coverage.

If you own your home as opposed to leasing it, some insurers will provide you a discount rate on your auto insurance policy premium, also if your residence is insured through another firm - insurance company. Various Other than New Hampshire and also Virginia, every state in the country calls for vehicle drivers to maintain a minimum quantity of responsibility coverage Get more info to drive lawfully - risks.

Car Insurance Costs Around $700 More Than Before Pandemic for Beginners

It may be tempting to stick with the minimal limits your state calls for to minimize your costs, yet you might be putting yourself in danger. State minimums are notoriously low and also might leave you without ample defense if you remain in a severe mishap. The majority of professionals recommend preserving sufficient coverage to secure your properties (cheaper).